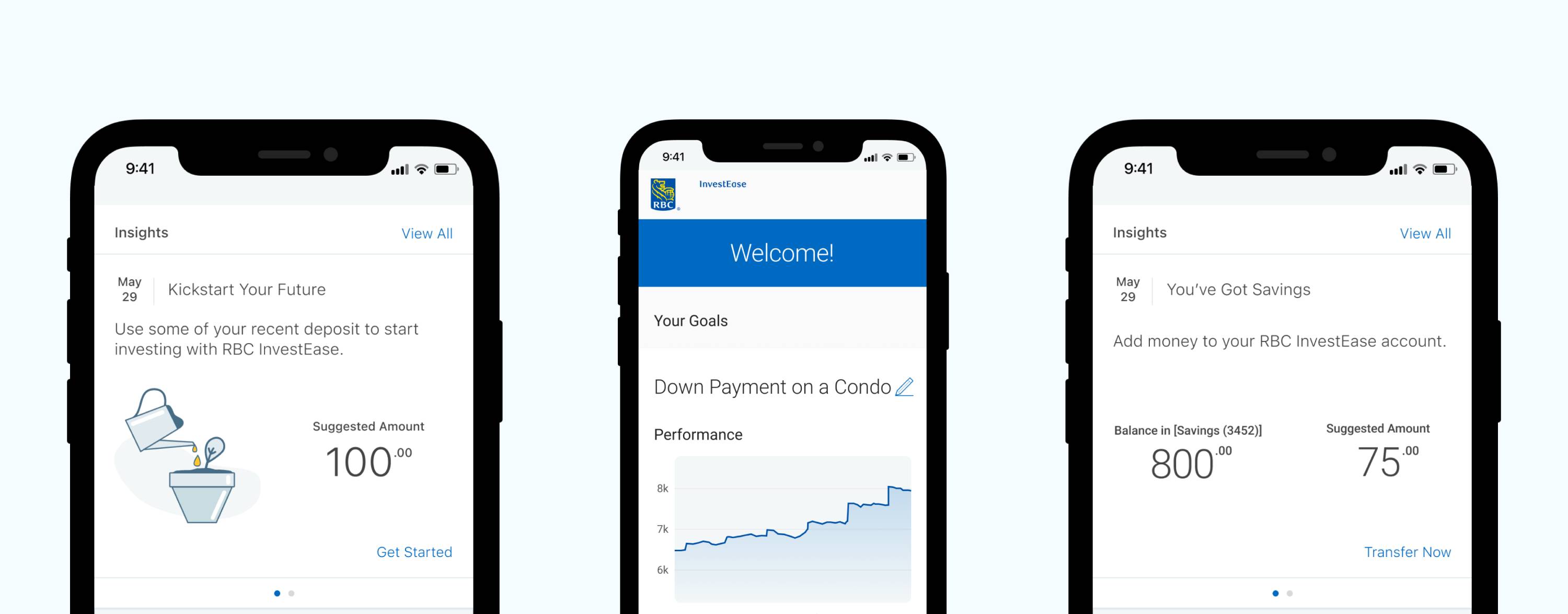

The new NOMI Insights for RBC InvestEase help you make progress towards your financial goals by letting you know when you may have spare cash available to invest.

We know that your long-term financial goals have some impressive competitors. There’s your credit card bill, the rent (or mortgage payment) due each month, and that extra special trip you’re planning now that travel restrictions are easing. So it makes sense that in a recent survey, 56% of our clients shared “not having enough money to invest” as one of their top hurdles to investing.1

As an investment service on a mission to make smart investing easy for more Canadians, we knew this was a challenge we could help with. That’s why we’re thrilled to announce that we’ve joined forces with NOMI InsightsTM to bring RBC clients timely, personalized investing insights in the RBC Mobile app.2

Let’s dig in to the details.

What are NOMI Insights?

If you’re an RBC client, you may have already met NOMITM. The built-in intelligence of NOMI, which powers services like NOMI Insights, helps RBC clients manage their everyday finances with tailored trends and overviews based on their RBC banking habits. NOMI Insights will work for your RBC chequing, savings or credit card accounts, if your accounts have been active for the past 3 months.

Did one of your subscriptions increase in price? Did that refund arrive in your account? How much did you spend on dining out versus groceries last month? NOMI Insights can let you know.

The new NOMI Insights for RBC InvestEase are the first investment-focused insights to be added to RBC’s award-winning NOMI offering.3

How do the investing insights work?

These investing insights are automatically generated when NOMI’s predictive technology finds extra dollars it thinks you won’t miss – based on your personal spending and saving habits.

RBC InvestEase clients can take action on these insights with just a few clicks – adding NOMI’s suggested amount, or whatever amount they choose, to their investment account in real-time.4 As usual, once funds are deposited5, the RBC InvestEase Portfolio Advisors do the heavy-lifting for you: picking, buying and managing your investments according to your account’s recommended portfolio.

If you don’t invest with RBC InvestEase yet, these insights will provide you with a personalized first deposit suggestion and a seamless path to open and fund an account.6 As an RBC client, you can choose to auto-fill your RBC profile information for an even faster sign-up experience. This makes RBC the first bank in Canada to offer clients AI-driven nudges that allow them to open and fund an investment account that's managed for them by professionals.

You have control over whether you take action on these insights. And they can also serve as simple reminders of your longer-term goals while you’re making everyday spending and saving decisions. These timely, personalized insights help you make the kind of everyday decisions that keep you on track towards the financial goals important to you. And help you realize the power of investing even small amounts, regularly over time.

This new capability complements NOMI’s fully-automated savings service, NOMI Find & SaveTM – a service that’s helped RBC clients put aside more than $2 billion dollars in savings since its launch in 2017. If you have NOMI Find & Save turned on, these new insights will also let you know when a portion of those savings could be better off invested. If you don’t have a NOMI Find & Save account, you’ll still get insights to invest from your RBC chequing or savings account.

Is my privacy protected?

At RBC, we are dedicated to protecting your privacy and safeguarding your information and accounts. The NOMI Insights you receive are never shared and are for your personal use only. All your personal banking information is encrypted and safely stored, and with the RBC Digital Banking Security Guarantee your eligible digital transactions are fully protected.7

Where can I sign up for NOMI Insights?

RBC Mobile app clients are automatically enrolled in NOMI Insights. To see NOMI Insights, scroll down to the NOMI section on your RBC Mobile app dashboard. Then scroll through the carousel to see each insight and tap on one to see more. You can access up to 40 days of insights.