How Our Pros Invest for You

Your hard-earned money is invested in a portfolio of low-cost ETFs and cash.

To meet your goals, your investment portfolio will hold a diverse mix of asset classes.

Based on your needs, you can hold your investment portfolio in a TFSA, RRSP or non-registered account.

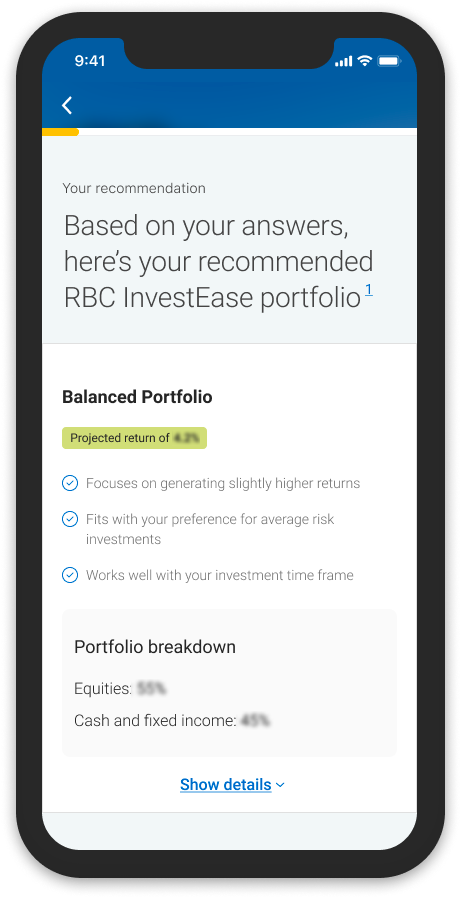

How We Create Your Investment Portfolio

The ETFs we buy for your portfolio will depend on your answers to our online questionnaire. For example, if you’re investing for retirement and have 30 years to save, we may recommend a different portfolio than if you’re investing for a home and need the money in a few years.

ETFs are flexible investments that offer a range of benefits, including:

- Diversification—this is a strategy used to reduce risk by holding securities across a variety of issuers, asset types, sectors, industries and geographies

- Lower fees than mutual funds

- Liquidity, which means they are easily bought and sold

Choose a Standard or Responsible Investing Portfolio

All of the investment portfolios we offer are available in two versions—Standard and Responsible Investing.

Here’s how each type stacks up:

Ideal if you want to:

Invest in your future.

Portfolio Features:

- Globally diversified

- Built with low-cost ETFs that seek to track high-quality, established market indexes

Investments held:

Mix of fixed income ETFs, equity ETFs and cash based on your goals and risk profile

At RBC InvestEase, your investment portfolio will include the ideal mix of fixed income and equity ETFs and cash to meet your financial goals and tolerance for risk.

Learn more about the ETFs we use in our portfolios:

- iShares Core Canadian Short Term Bond Index ETF (opens in a new window)

- iShares Core Canadian Universe Bond Index ETF (opens in a new window)

- iShares Global Government Bond Index ETF (CAD-Hedged) (opens in a new window)

- iShares Core S&P/TSX Capped Composite Index ETF (opens in a new window)

- iShares Core S&P 500 Index ETF (opens in a new window)

- iShares Core MSCI EAFE IMI Index ETF (opens in a new window)

- iShares Core MSCI Emerging Markets IMI Index ETF (opens in a new window)

Professionally managed and rebalanced for you:

Yes

Low Annual Management Fee:

0.5% on your investment balance

Management Expense Ratio (MER) (opens modal window) :

0.11%–0.13%

Ideal if you want to:

Invest in your future and a better world.

Portfolio features:

- Globally diversified

- Built with low-cost ETFs that optimize for higher environmental, social and governance (ESG) scores while seeking returns similar to broad markets

- Excludes companies involved in tobacco, controversial weapons, civilian firearms and severe controversies

Investments held:

Mix of fixed income ETFs, equity ETFs and cash based on your goals and risk profile

At RBC InvestEase, your investment portfolio will include the ideal mix of fixed income and equity ETFs and cash to meet your financial goals and tolerance for risk.

Learn more about the ETFs we use in our portfolios:

- iShares ESG Aware Canadian Short Term Bond Index ETF (opens in a new window)

- iShares ESG Aware Canadian Aggregate Bond Index ETF (opens in a new window)

- iShares Global Government Bond Index ETF (CAD-Hedged) (opens in a new window)

- iShares ESG Aware MSCI Canada Index ETF (opens in a new window)

- iShares ESG Aware MSCI USA Index ETF (opens in a new window)

- iShares ESG Aware MSCI EAFE Index ETF (opens in a new window)

- iShares ESG Aware MSCI Emerging Markets Index ETF (opens in a new window)

Professionally managed and rebalanced for you:

Yes

Low Annual Management Fee:

0.5% on your investment balance

Management Expense Ratio (MER) (opens modal window) :

0.18%–0.23%

Performance Trends Of The Various Portfolio Types

Put Your Money to Work in a Variety of Account(s)

You can hold your investment portfolio(s) in one or more of the following account types.

Tax-Free Savings Account (TFSA)

Save for emergencies, a home, retirement and more without paying tax on the money you earn.

- Use for short or long-term goals

- Capital Gains in your TFSA are never taxed

- Withdraw funds at any time without being taxed

- Contribute up to $6,500 in a year, plus unused contribution room you have from any prior year(s)

- You can open more than one TFSA, but your contribution limit is the same whether you hold one or multiple TFSAs

Registered Retirement Savings Plan (RRSP)

Designed for retirement savings, an RRSP offers tax benefits now and in the future.

- Reduces your taxable income

- Ideal if you don’t need access to your investments until you retire

- Borrow from it to buy your first homeLegal Disclaimer 1 or pay for your or your spouse’s educationLegal Disclaimer 2

- Contribute (per year) the lower of 18% of your earned income from the prior year, the maximum limit for the current tax year, or the remaining limit after any contributions you’ve made to a company-sponsored pension plan

- You can open more than one RRSP, but your contribution limit is the same whether you hold one or multiple RRSPs

Non-Registered Investment Account

Save for any goal in a flexible account that gives you easy access to your money.

- Contribute as much as you want and withdraw money when needed

- Use for short or long-term goals

- Does not reduce your taxable income and earnings in your account may be taxed

Ready to Start Investing?

Get a professionally-built and managed investment portfolio without the work.

Other products and services may be offered by one or more separate corporate entities that are affiliated to RBC InvestEase Inc., including without limitation: Royal Bank of Canada, RBC Direct Investing Inc., RBC Dominion Securities Inc., RBC Global Asset Management Inc., Royal Trust Corporation of Canada and The Royal Trust Company. RBC InvestEase Inc. is a wholly-owned subsidiary of Royal Bank of Canada and uses the business name RBC InvestEase.

The services provided by RBC InvestEase are only available in Canada.

An exchange-traded fund (ETF) is similar to a mutual fund, except an ETF trades like a stock on an exchange. Like a mutual fund, you can buy “units” in an ETF to own a proportional interest of a pool of assets (such as stocks or bonds).

Indexed ETFs commonly track a specific:

- Market index (a composite of securities, such as the S&P/TSX Composite Index)

- Market sector (a group of stocks representing companies in similar lines of business)

- Commodity (such as precious metals or energy futures)

An asset class is a grouping of investments that share similar features. Stocks (equities) and fixed income investments, such as bonds, are two of the main types of asset classes. Cash and cash equivalents is the third most common type of asset class.

An investment portfolio is a mix of investments, combined in such a way as to meet a specific financial goal and to match a person’s tolerance for investment risk and time horizon.

For example, depending on your reasons for investing and how long you have to invest, your portfolio could be focused on aggressive growth, moderate growth, protecting and preserving your money, or a balance of growth and preservation.

Additional account options are coming soon!

We plan to offer other accounts in the future, such as a Locked-In Retirement Account (LIRA), Restricted Locked-in Registered Retirement Savings Plan (RLSP), Registered Retirement Income Fund (RRIF), Registered Education Savings Plan (RESP) and joint accounts.

The Management Expense Ratio (MER) includes a few different costs:

- Annual management fee: Paid to the fund manager for acting as a trustee and manager.

- Operating expenses: Covers fees to comply with regulatory requirements and fees payable to the ETF’s board of governors.

- Taxes: These are the sales taxes on management and administration fees charged to the fund.

Investment funds pay investment fund managers a fee for managing their funds. You are not directly charged the management fee. But, these fees affect you because they reduce the amount of the fund’s return to you. Information about management fees and other charges to your investment funds is included in the prospectus or fund facts document for each fund.

See our FAQs for a detailed explainer.