We Pick, Buy and Manage Your Investments for You

Unlike do-it-yourself (DIY) investing, where you research, buy and manage your own investments, we do it for you—all for a low fee.

You Do a Little…

Answer some simple questions so we can get to know you.

Select, open and fund your account.

Make deposits anytime you want—even set them on autopilot.

Get back to enjoying your life—we're here if you need us.

We Do a Lot…

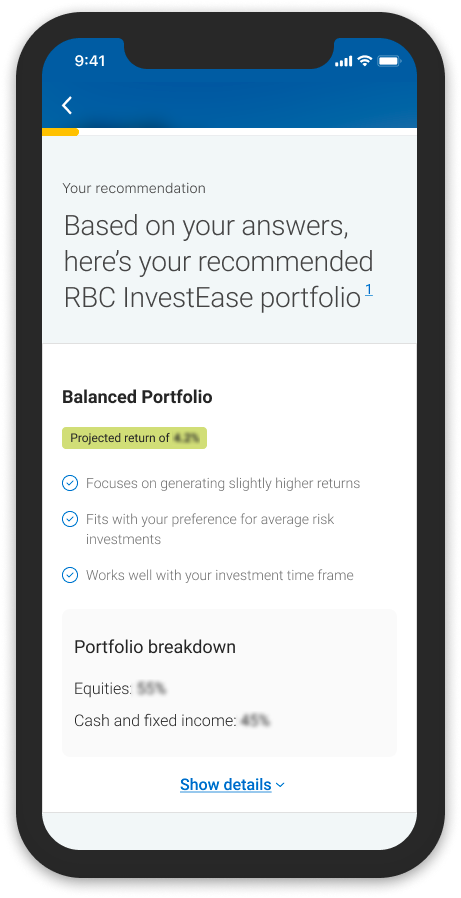

Match you to one of our five investment portfoliosLegal Disclaimer 1.

Invest your money in low-cost exchange-traded funds (ETFs) according to your portfolio.

Manage your investments so you keep progressing toward your goal.

Offer support if you have questions or want personalized investment advice.

Here's a Closer Look at How It All Works

Answer a few questions to get your portfolio recommendation.

You’ll need to share some info so that we can match you to the right portfolio (opens modal window) of ETFs (opens modal window). We’ll ask you about:

- Your investing timeframe

- How much you want to invest

- Your feelings about risk

Your portfolio will be designed to align with your plans and preferences. You can even choose a Responsible Investing Portfolio.

- Explore our ETF Portfolios and see their performance.

An investment portfolio is a container that holds all your investments...like stocks, ETFs, mutual funds and cash.

At RBC InvestEase, our portfolios are made up of ETFs and cash.

Explore our ETF Portfolios.ETFs are designed to hold stocks and bonds in a single container. That container is a fund you can buy.

While they're similar to mutual funds, ETFs don't have investment minimums. Also, an ETF can offer more trading flexibility since it trades on an exchange (like a stock) throughout the day, with prices fluctuating continuously.

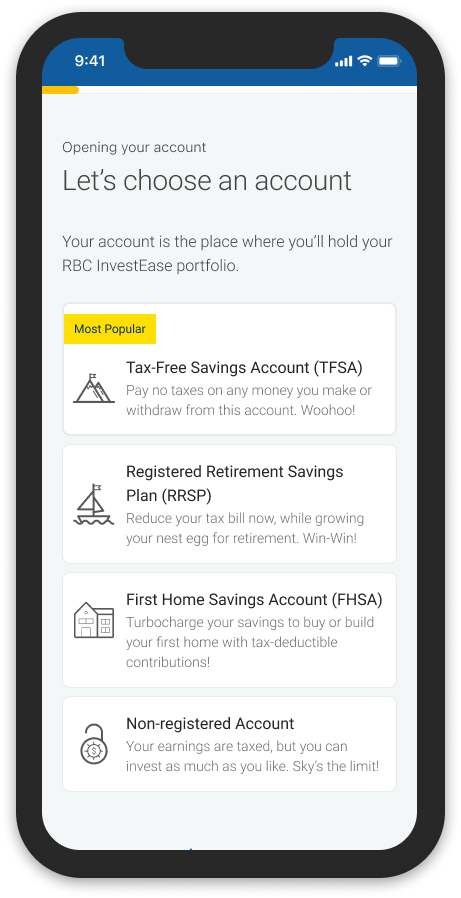

Select, open and fund your account so we can invest for you.

While we recommend the right portfolio for you, you get to select the account (opens in new window) to hold it in. Choose from a:

- Tax-Free Savings Account (TFSA)

- First Home Savings Account (FHSA)

- Registered Retirement Savings Plan (RRSP)

- Non-registered account

Next, finish opening your account and make your first deposit. You can start with any amount (opens modal window) you’re comfortable with. We’ll automatically invest your money when your balance reaches $100 or moreLegal Disclaimer 2.

Tip: Not sure what’s right for you—or need a different account? Call us at 1-800-769-2531 and one of our Portfolio Advisors can help guide you.

For balances of $100 to $1,499, we invest in a “Small Balance portfolio,” which is similar to a full portfolio, but with fewer exchange-traded funds (ETFs).

When your balance rises above $1,500, we transition you to a full portfolio. The best part? There's no additional cost or action you need to take.

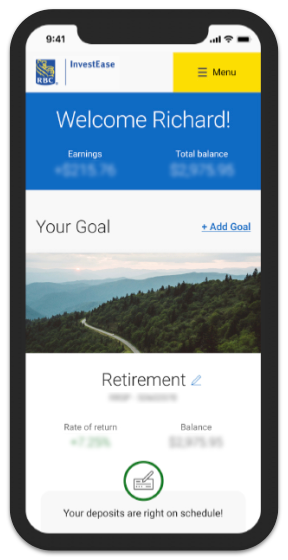

Make deposits at any time, while we keep you on track.

To see how your investments are doing, open a new account, or transfer money, simply log in to your dashboard.

If you’re an RBC client, you can also access your account from RBC Online BankingLegal Disclaimer 3 and the RBC Mobile appLegal Disclaimer 4 to see all of your accounts in one spot and transfer funds in real-time during business hours. (Check out more perks for RBC clients.)

Our Portfolio Advisors will keep an eye on your investments and rebalance (opens modal window) your portfolio to help you stay on track toward your goal.

In the world of investing, balance is having the right mix of investments (or assets) in your portfolio to help reach your goals.

Over time, deposits, withdrawals and performance can cause your portfolio to drift from its original mix. To help keep your portfolio on track, we will buy or sell the appropriate exchange-traded funds (ETFs) to rebalance your portfolio.

Get back to enjoying your life—we're here if you need us.

Other than adding money to your account so that we can continue to invest for you, there’s nothing else you need to do!

Best of all, if you have questions, our Portfolio Advisors are here to help. Just give us a call at 1-800-769-2531 or email us.

Want to learn more about our Portfolio Advisors? Check out their credentials and how they can help you reach your financial goals.

FAQs

RBC InvestEase charges an annual management fee of 0.50% + applicable sales tax (billed monthly, based on your account’s average Assets Under Management). A weighted average management expense ratio between 0.11%–0.23% will apply to the ETFs held in your portfolio.

Start small or start big - it’s up to you. Your money is invested once you reach a balance of $100 or more, to allow you to start saving for your goals without having to save up thousands of dollars first.

For balances of $100 to $1,499 we invest you in a “Small Balance portfolio,” which obtains similar exposure to the full Standard and Responsible Investing portfolios through the purchase of fewer ETFs. We offer a Small Balance portfolio to help get more Canadians off the side-lines and investing for their future. Our Small Balance portfolio is necessary because we do not purchase fractions of ETFs (these are also known as “fractional shares”), which makes the construction of a diversified portfolio more difficult for values below $1,500.

When your account balance rises above $1,500 we would transition it to a full Standard or Responsible Investing portfolio (which contain four to six ETFs) at no additional cost and no action required by you.

Yes, no problem! You can open an account with RBC InvestEase even if you don’t currently bank with RBC. Also, you can easily move money to your account by transferring funds or investments from another financial institution.

Our Portfolio Advisors make decisions for and manage the investment portfolio you hold in your TFSA, RRSP, FHSA or non-registered account(s). For example, we keep an eye on your investments and rebalance your portfolio as needed to help you stay on track toward your goals.

You are responsible for things like making deposits to your account(s) (which we invest for you), updating pre-authorized contributions if you have them and keeping track of your available contribution room (if applicable).

$1,500 and Beyond: Congrats! We have enough money to purchase the full list of ETFs in your Standard or Responsible Investing portfolio. Where can I find more details about the ETFs RBC InvestEase uses to create my portfolio?

$100 - $1,499: You are invested in a Small Balance portfolio, which obtains similar exposure to the full Standard and Responsible Investing portfolios through the purchase of fewer ETFs. We offer a Small Balance portfolio to help get more Canadians off the side-lines and investing for their future. Our Small Balance portfolio is necessary because we do not purchase fractions of ETFs (these are also known as “fractional shares”), which makes the construction of a diversified portfolio more difficult for values below $1,500. When your account balance rises above $1,500 we would transition it to a full Standard or Responsible Investing portfolio (which contain four to six ETFs) at no additional cost and no action required by you.

A Standard Small Balance Portfolio will use the following ETFs:

A Responsible Investing Small Balance Portfolio will use the following ETFs:

$0-$99: Your money will stay in cash until you reach a balance of $100 or more.

Your investment portfolio uses an asset allocation mix – a combination of stocks, bonds and cash determined by your risk profile – to help you reach your investment goals. As time passes, your portfolio may drift from the original mix (or target allocation) due to the relative performance of each asset class or because of deposits and/or withdrawals.

As a result, your portfolio may become unbalanced with too much of one asset class or too little of another. When this happens, RBC InvestEase buys or sells the required (ETF) units to bring you back to your original target allocation. Rebalancing ensures that your portfolio stays in line with your objectives.

Our Portfolio Advisors can answer any questions you have about your RBC InvestEase investment portfolio, as well as general financial questions. Here are some examples of things you could ask a Portfolio Advisor:

- How can I better balance all my financial goals and priorities?

- My situation has changed—how can I update my investment plan?

- What account type will maximize my tax savings and investment growth?

- How is my portfolio risk impacting when I’ll reach my goals?

You don’t need any investing experience or know-how to invest at RBC InvestEase. We’ll pick, buy and manage your investments for you based on your responses to some simple questions. Plus, our Portfolio Advisors are available if you have questions or need advice.

Ready to Start Investing?

Get a professionally-built and managed investment portfolio without the work.

The services provided by RBC InvestEase are only available in Canada.