At RBC InvestEase, our investment portfolios are comprised of globally-diversified exchange-traded funds, or ETFs as they are more commonly known. The portfolio advisory team analyzes the ETFs we utilize ensuring they adhere to a strict set of requirements, so our portfolios are well diversified, low-cost, and maintain adequate liquidity.

To better understand how ETFs work and the benefits they offer investors, we have compiled an overview of the building blocks of our portfolios.

ETFs and Mutual Funds

First, let’s start with a history lesson. Mutual funds have been around for generations, so you may be somewhat familiar with them. ETFs, on the other hand, are relatively new. In fact, Canada was a pioneer in the development of ETFs with world’s first ETF, XIU, launching on the Toronto Stock Exchange in March 1990. Incidentally, XIU is still trading and is part of RBC iShares suite of ETFs.

ETFs and mutual funds share several similarities. Fundamentally, both investment vehicles enable investors to pool their money into a fund that allows them to purchase stocks, bonds, currencies, and commodities. The key differences between the two lies in how they are priced and traded.

Mutual funds are priced and traded once per day at their closing net asset value. That means that all buyers and sellers of that mutual fund in a single day will buy or redeem their units at the exact same price.

Meanwhile, ETFs (as their name suggests), trade on the stock exchange like any other publicly-traded stock and, as a result, their price fluctuates throughout the trading day. As with stocks, traders need to be aware of market liquidity and the bid-ask spread when trading and evaluating ETFs.

Passive vs. Active Investments

Historically, ETFs (including XIU) have generally been passive investment vehicles. Passive investing refers to the investment strategy of setting up your portfolio to track the performance of an underlying index (like the S&P/TSX 60 in Canada or the S&P 500 in the United States).

For example, XIU tracks the S&P/TSX 60 Index, a stock index that tracks 60 large publicly-listed Canadian companies across various industries and sectors. As the index rises and falls, XIU will aim to mirror the performance of the index.

On the other hand, most mutual funds tend to be actively managed, and a fund manager will aim to outperform a benchmark. For example, while XIU aims to track the S&P/TSX 60 Index, an actively-managed Canadian equity mutual fund will try to achieve a performance that is above the index.

A key feature of passively-managed funds is that the fund management fees are typically lower than actively-managed funds. They also arguably offer the investor greater transparency since information about the components of the index is widely available and holdings within the index do not to change frequently. ETF holdings are updated daily, whereas mutual fund holdings are only disclosed quarterly.

Nowadays, there are both passively managed mutual funds and actively-managed ETFs, blurring this earlier distinction between the two fund types.

Popularity Contest

Recently, passive investing has surged in popularity. While active funds continue to manage the majority of money invested through investment funds, passive funds have enjoyed large inflows and have consistently gained share.

The debate between active versus passive investing has raged since passive investing first emerged, and there are merits to both approaches. At RBC InvestEase, we take advantage of the low fees and liquidity offered by passively managed RBC iShares ETFs while still actively overseeing our portfolio asset allocations.

Being Mindful of Risk and Diversification

Regardless of whether you invest in mutual funds or ETFs, you will have exposure to a diverse variety of assets within the fund.

Conversely, suppose you buy shares or bonds in a single company. In this scenario, you will be exposed to risks unique to that company alone also known as idiosyncratic risk. For example, the company may sell products that are no longer competitive. This could in turn hurt the company’s share price. Alternatively, the company might have borrowed excessively, and investors worry that the company may no longer be able to pay its debts. This could then decrease the value of the bonds the company issues.

When you hold several assets (across different industries, different countries, etc.), your portfolio will have reduced vulnerability to the unique risks associated with each company as they will only represent a small portion of your portfolio. This is known as diversification. By diversifying your portfolio, you are reducing idiosyncratic risk.

It is still important to keep in mind that stocks (and bonds), by nature, can be volatile and even a diversified portfolio will carry a degree of risk. This is known as systematic risk.

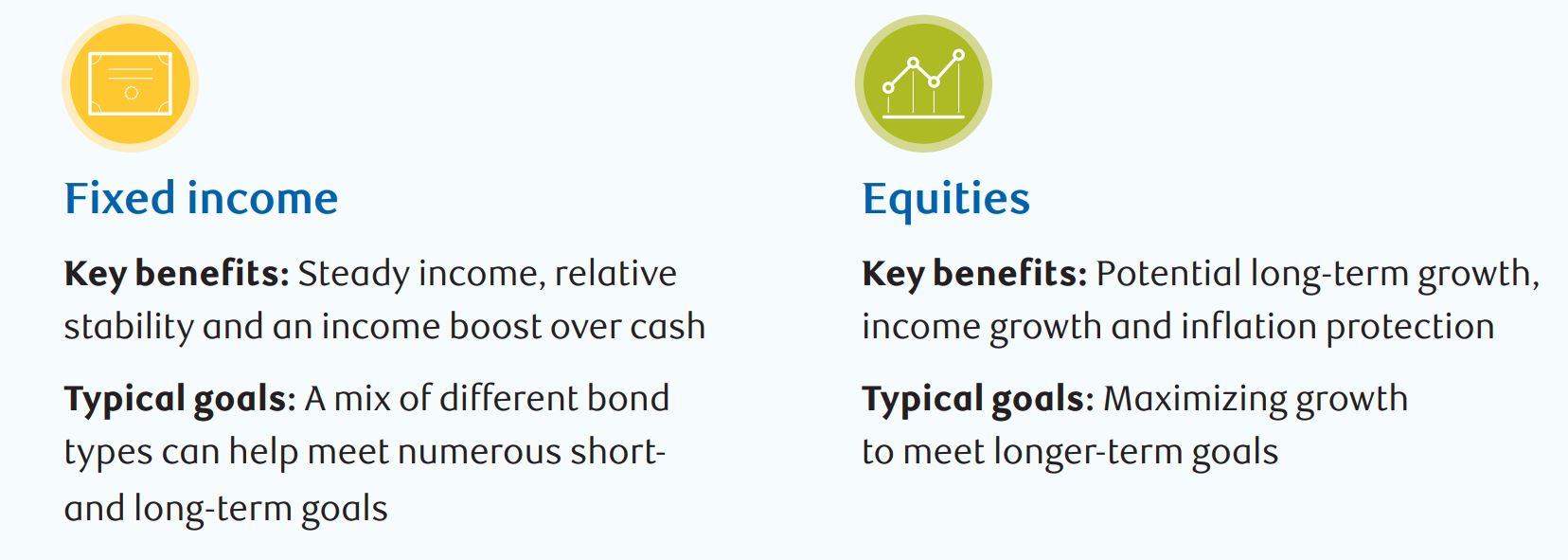

While we may not be able to eliminate systematic risk, we can aim to reduce it by building a portfolio that holds stocks and bonds, as they each present their own unique features and risks:

By incorporating both stocks and bonds in a portfolio, we can take advantage of the benefits each asset class offers and build a portfolio that better manages systematic risk.

We’ve Got You Covered

At RBC, we use equity and fixed income ETFs to thoughtfully diversify our portfolios in order to manage risk and ensure that your investments are best positioned to help you achieve your financial goals.

As always, if you have any questions or would like to learn about ETFs and how we build our portfolios, our team of Portfolio Advisors are happy to share their advice!