During our inaugural online webinar on October 26th, RBC InvestEase Portfolio Advisors received a number of questions on inflation. We thought it might be helpful to further address this subject and expand on answers we provided that day.

Inflation refers to a general increase in the price of goods and services in an economy. All consumers have a tangible experience with inflation. Whether it is the price of groceries, streaming subscriptions, or car repairs, we can feel that the prices of these goods and services have recently increased rather dramatically. In fact, inflation is at a 40 year highLegal Disclaimer 1. Despite the tangibility of inflation, it can be a tricky statistic to measure.

Measuring Inflation

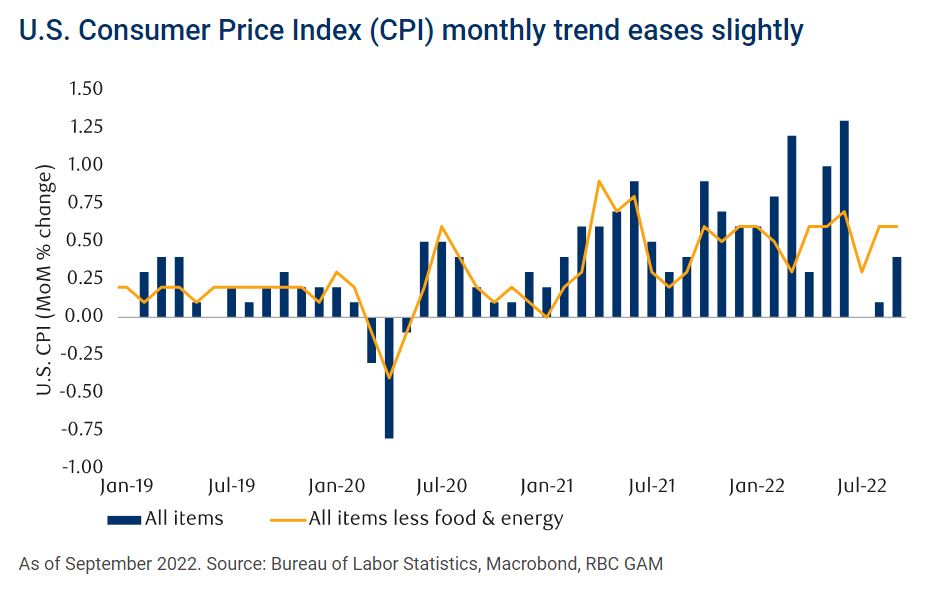

Measuring the degree by which prices of goods and services are increasing is similar to measuring your personal health. No one statistic (weight, body mass, or heart rate) can accurately determine how healthy you are. Instead medical professionals use several data sources to determine your health. Economists apply the same principle to inflation. The most commonly discussed measure of inflation in the media is the Consumer Price Index or “CPI”. While this statistic is helpful in understanding overall inflation, some of its components such as food and energy can be extremely volatile and influenced by extraordinary events (such as natural disasters, wars, etc.). Therefore, economists adjust CPI by removing some of those more volatile components. As we can see in the chart below, U.S. Consumer Prices for all items exhibit lower lows and higher highs versus when food and energy prices are excludedLegal Disclaimer 2.

Why Inflation is Important

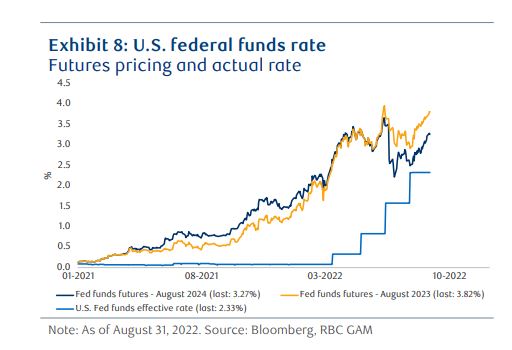

If left unchecked, inflation can have disastrous effects on an economy as it diminishes the purchasing power of money. When you are spending more of your money on goods and services, this leaves you with less money to save and invest. Without investment, companies cannot fund expansion, and economic activity slows. Unfortunately, central banks are limited in the tools at their disposal to curtail inflation. The most powerful ’tool’ for combating inflation is increasing the rate at which banks can borrow and lend money to each other. In the US, that is the Federal Funds RateLegal Disclaimer 3 and in Canada, it is called the Bank of Canada’s Policy Interest RateLegal Disclaimer 4.

Higher interest rates slow economic activity since it makes borrowing more expensive. Slower economic activity results in less demand, which effectively lowers the prices for goods and services. It may seem as though raising interest rates is like cutting of your arm to save your hand, but the prevailing economic theory is that the resulting reduction in economic activity is not as bad as the reduction in economic activity from unchecked inflation.

How Inflation and Interest Rates impact Investment Portfolios

The impact of higher inflation and hence higher interest rates can be dramatic on investment portfolios, and fixed income allocations specifically. Fixed income investments are particularly sensitive to changes in interest rates. Imagine if you loaned money to a friend last year. Let’s call them Joe. Joe is very trustworthy and likely able to pay interest and repay the loan after 3 years, so you agree to charge them an interest rate of 2% every year for the length of the loan. You were only earning 1% from your bank account so lending to Joe at 2% was a good decision with a small risk. Now, imagine that the interest you could earn in your bank account increased to 3%. All of a sudden that loan isn’t as good a business decision as before; Joe will still pay you back, but you could have earned more from your bank account. Unfortunately, you already committed to helping Joe. This simplified scenario is exactly what happened to fixed income prices over the past year. Invested funds were locked in at rates that were satisfactory at the time of investment, but are no longer attractive now that interest rates have increased throughout the global economy.

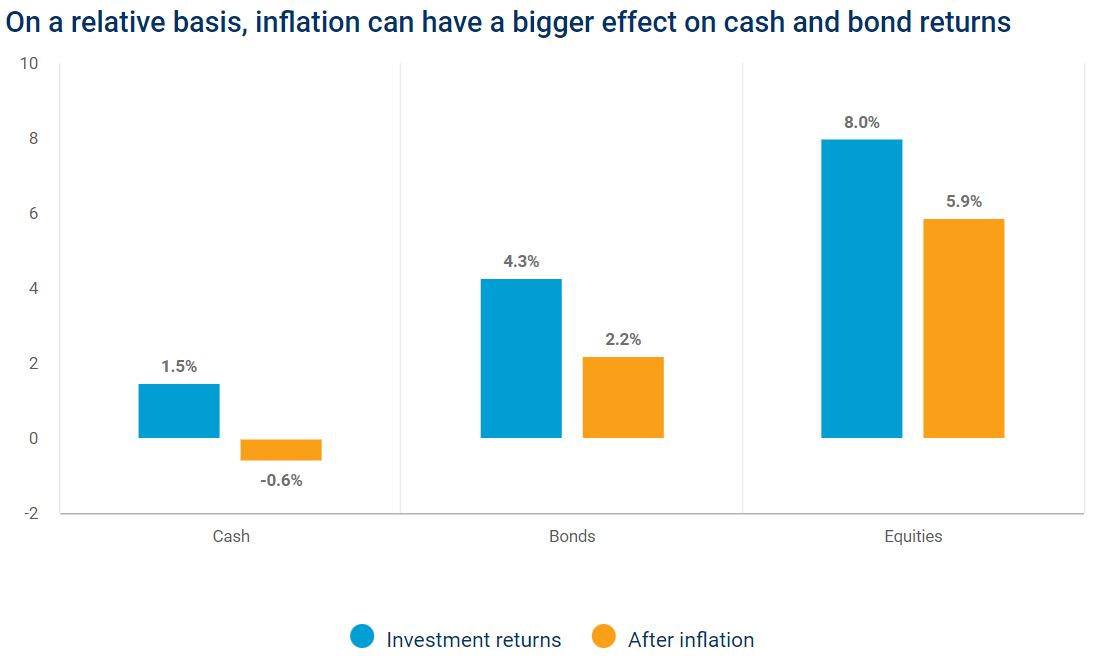

That being said, foregoing fixed income altogether is not a good solution either. Despite the pain felt by investors in fixed income markets, those in the stock market have suffered even more this past year. Higher interest rates, negatively impact stock markets as well. After all, why assume the risk of investing in the stock market when you can now earn a nearly risk free rate of return of 4-5% by buying a GIC? Despite the recent pullback, stocks have historically performed better than fixed income investments during periods of rising inflation (see below).

This is partially due to the ability of some larger companies to increase the prices of their goods and services to keep up with inflation, whereas fixed income investments don’t have such flexibility and are more sensitive to rising interest rates.

Bottom Line

The past year has been a difficult one for all investors and for all asset classes. Inflation and rising interest rates have affected investments in dramatic and nuanced ways. To weather periods of volatility, it is critical that investors have a diversified portfolio that is suited to help them achieve their financial objectives within their time horizon and risk tolerance. Thankfully, that is exactly what your team at RBC InvestEase is dedicated to doing.