“The next recession. Toxic politics and constrained central banks could make the next downturn hard to escape”Legal Disclaimer 1 – The Economist

“Why are markets falling, and are we heading for a global recession?Legal Disclaimer 2” – The GuardianThe following headlines certainly sound familiar, but they are actually from the fall of 2018. In today’s environment, investors are once again weighing the risk of recession and what that might mean for financial markets. But investors face some sort of decision dilemma every year. What might surprise you is the importance (or lack thereof) of trying to time these investment decisions. Fortunately, our partners at RBC Global Asset Management (GAM) ran the numbers on market timing and the results are enlightening.

Comparing five different approaches

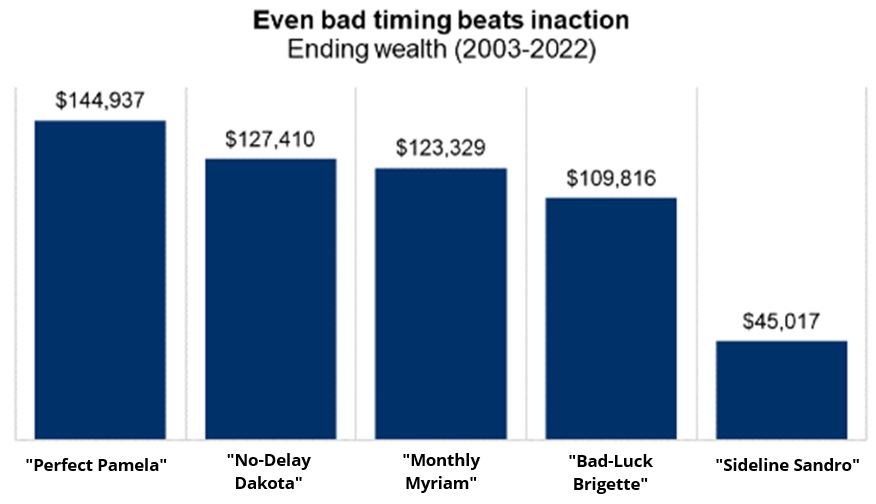

Let’s look at five hypothetical investors with different approaches – and results. Each received $2,000 at the beginning of every year for the last 20 years and had the option to invest in the stock market. Here’s how they differed:

- Perfect Pamela was a perfect market timer. She had incredible skill (or luck) and was able to place her $2,000 into the market every year at the lowest closing point.

- No-delay Dakota took a simple, consistent, and repeatable approach. Every year on the first trading day of the year, he invested his $2,000 in the market.

- Monthly Myriam used dollar-cost averaging to invest her annual amount over 12 equal monthly contributions.

- Bad-luck Brigette had the worst luck imaginable. She invested her $2,000 each year at the market’s highest point. She would usually see her portfolio decline in value immediately after making her annual contribution.

- Sideline Sandro left his money in interest-earning cash investments every year. He was always worried stocks might go lower as soon as he invested, and so never got around to investing in stocks at all.

You cannot invest directly in an index. Additional fees may apply.

Source: Morningstar, RBC GAM. Based on $2,000 invested annually based on the stated approach. Performance based on S&P 500 Total Return Index CAD-Hedged. ‘Stay in cash’ assumed investment in FTSE Canada 30 Day TBill Index

The results are in:

- Naturally, Pamela’s perfect timing led to the best results. She accumulated $144,937.

- But for those of us without crystal balls, Dakota’s results are perhaps of most consequence. By following an incredibly simple approach of investing at the start of each year, he came in second with $127,410. (A difference of $17,527 may seem significant, but that equates to $876.35 per year – don’t forget that “Perfect Pamela” does not exist)

- Myriam’s dollar-cost-averaging approach came in third with $123,329. That’s just a little bit behind Dakota’s strategy of investing first thing each year ($4,081 dollars over 20 years). This didn't surprise us. Because markets tend to rise over time, stretching her investments over each year meant Myriam tended to participate in a bit less of that growth than Dakota.

- Despite her bad luck, Brigette’s results are surprisingly encouraging. While her terrible timing left her behind the other stock market investors, Brigette still nearly tripled her wealth compared to if she had not invested at all (just like “Perfect Pamela”, “Bad Luck Bridgette” does not exist either).

- Sandro’s results standout for the wrong reasons. By continually waiting for a better opportunity to buy stocks, he fared worst of all. His biggest fear had been investing at market highs. Ironically, doing exactly that would have left him with more than twice the wealth than remaining on the sidelines.

Helping clients to avoid inaction

While we looked at the last 20 years here today (a time period that included some historically volatile years), the results are incredibly consistent over history. Even in periods where the success of hypothetical investors differed, investing at the start of each year never came in last – it usually remained second place or moved just to third.

Remember that without a crystal ball or the benefit of hindsight, it is nearly impossible to time the market perfectly. So instead, the best strategy for most investors involves building a plan that aligns their investment objectives, time horizon, risk tolerance and risk capacity. Next, once a suitable portfolio has been created, establish a plan to invest at regular intervals. Sooner is most often better, however dollar-cost-averaging can be a nice compromise for individuals that would find a lump-sum approach too stressful or are worried about bad timing.

Establishing a funding plan for your RBC InvestEase account

Fortunately, funding your RBC InvestEase account is a simple process:

- Log into your RBC InvestEase account

- Select ‘Move Money’ from the main menu

- Select ‘New Deposit’

- Select ‘From a Bank Account’

- Complete the required information for a one-time lump sum or to establish regular fixed amount deposits

With an RBC InvestEase account, you already benefit from cost effective investment portfolios that align your goals against risk factors. While none of us are a “Perfect Pamela”, implementing a plan to fund your account is as simple as a few clicks, and you can always speak to our team of portfolio advisors at 1-800-769-2531 if you are looking for additional advice.