What is Responsible Investing?

The Responsible Investing approach used by RBC InvestEase focuses on companies that score most favourably in the assessment of Environmental, Social and Governance risk factors. The process also draws on some elements of socially responsible investing by excluding companies involved in the business of tobacco, controversial weapons and civilian firearms. Companies involved in severe controversies are also excluded.

Our Investment Approach

Background

The Responsible Investing portfolios offered by RBC InvestEase are constructed with passive exchange-traded funds (ETFs) from RBC iShares. These ETFs invest in individual securities and/or other RBC iShares ETFs to gain the appropriate level of exposure required in our asset allocation models.

BlackRock Canada is the manager of the RBC iShares ETFs used in the Responsible Investing portfolios offered by RBC InvestEase, and is responsible for the day-to-day administration of the ETFs.

The RBC iShares ETFs use indices provided by MSCILegal Disclaimer 1 – for exposure to the equity markets of Canada, U.S, EAFE (Europe, Australasia and Far East) and the emerging markets and Bloomberg Barclays in collaboration with MSCI ESG Research for exposure to the fixed income markets of Canada and the U.S. For portfolios that have exposure to global government bonds, the iShares Global Government Bond Index ETF (ticker XGGB) is used. This security provides important diversification exposure that is not available through an equivalent security with ESG integration. Since most of the securities are fixed income securities issued by G7 sovereigns, an ESG scoring process would have limited benefit.

Parent Index and Exclusion

Each of the ETFs used in our Responsible Investing portfolios follow a similar process. First, the manager of the funds (Blackrock Canada) chooses an index provider for each market (MSCI or Bloomberg Barclays in collaboration with MSCI ESG Research). The index provider then excludes companies involved in the business of tobacco, controversial weapons and civilian firearms, as well as companies involved in very severe business controversies. The remaining companies represent the constituents of the applicable ESG Index. Finally, the index provider assesses each of the remaining companies through a rigorous ESG framework.

The following provides additional detail on each of these steps.

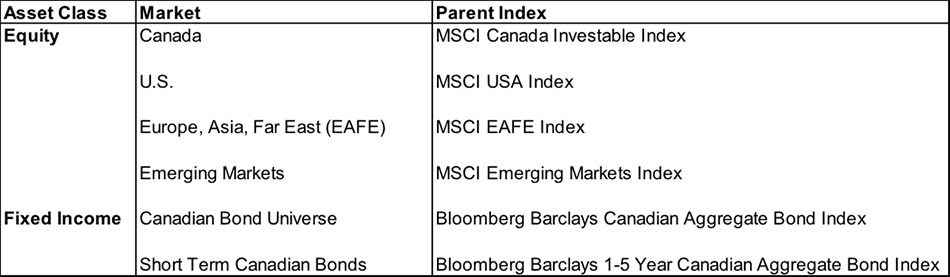

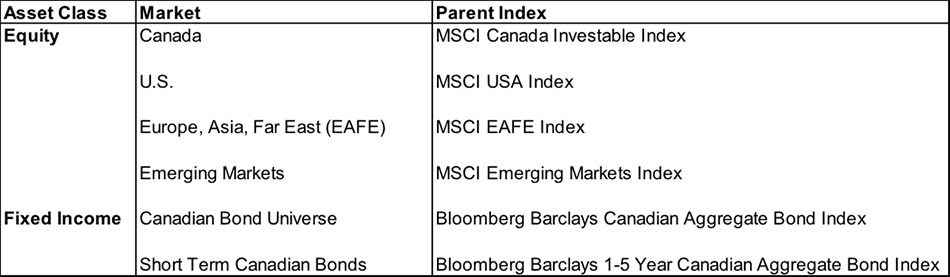

I. Selection of Parent Index

The Index Provider is responsible for selecting a Parent Index to achieve appropriate exposure to a particular market and asset class (i.e. Canadian equities, U.S. equities, etc.) included in our strategic asset allocation models. Exhibit 1 captures the parent index for each market.

Exhibit 1 Parent Index

II. Exclusion Criteria & Resulting Indices

Once the Parent Index has been identified, a screening process is used to exclude certain constituents.

i. ESG Controversy Score:

Incidents such as harassment claims, falsifying emission tests and many more may indicate a wider structural problem with a company’s risk-management capabilities, which could pose a future material ESG risk for the company. It is for this reason that assessing the risk of controversies is a crucial component of the MSCI ESG investment process., MSCI measures the scale and nature of the impact to assess its influence on ESG.

Once MSCI determines where a controversy falls within its assessment, it then assigns a score between zero and 10. A zero represents the “worst of the worst” – when a company is caught up in one or more very severe controversies. A 10 would be assigned to a company not involved in any controversies.

Any constituent that has been embroiled in a controversy and has received a score of zero out of 10 (which corresponds to a “Very Severe” controversy) is ineligible for inclusion.

Furthermore, any constituent that does not have a Controversy Score, due to a lack of information available to MSCI to carry out the assessment, is also ineligible for inclusion.

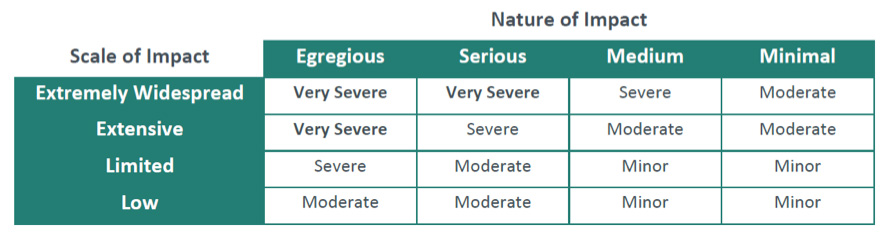

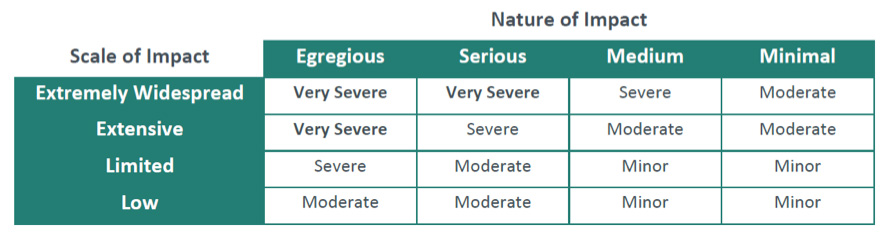

Exhibit 2 provides the range of outcomes given the nature and scale of the controversy impact under assessment.

Exhibit 2 Controversy Assessment

ii. MSCI ESG Business Involvement Screen:

Any constituent that does not have an ESG score is automatically ineligible from inclusion in the Index.

Furthermore, any business involved in the following activities is excluded from the Index:

- Tobacco:

- All companies classified as “Producer” or “Licensor”

- All companies classified as “Distributor,” “Retailer” or “Supplier” that earn 15% or more of revenues from tobacco products

- All companies classified as “Ownership by a Tobacco Company” or “Ownership of a Tobacco Company”

- Controversial weapons:

These include Cluster Bombs, Landmines, Depleted Uranium Weapons, and Chemical and Biological Weapons.- Producers of key components of the weapons

- Ownership of 20% or more of a weapons or components producer

- The minimum limit is raised to 50% for financial companies having an ownership in a company that manufactures controversial weapons or key components of controversial weapons

- Owned 50% or more by a company involved in weapons or components production

- Civilian firearms

Producers and retailers of civilian firearms are also excluded from index consideration.

ESG methodology

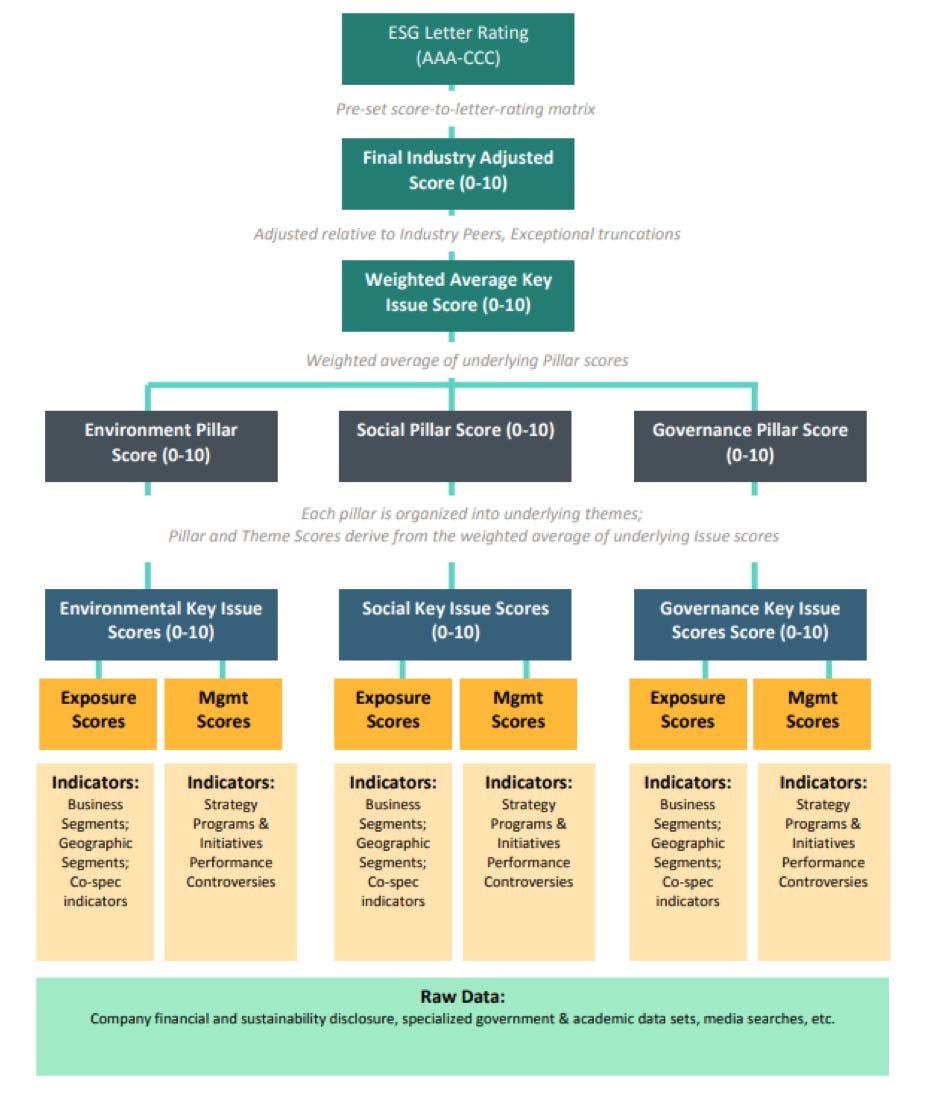

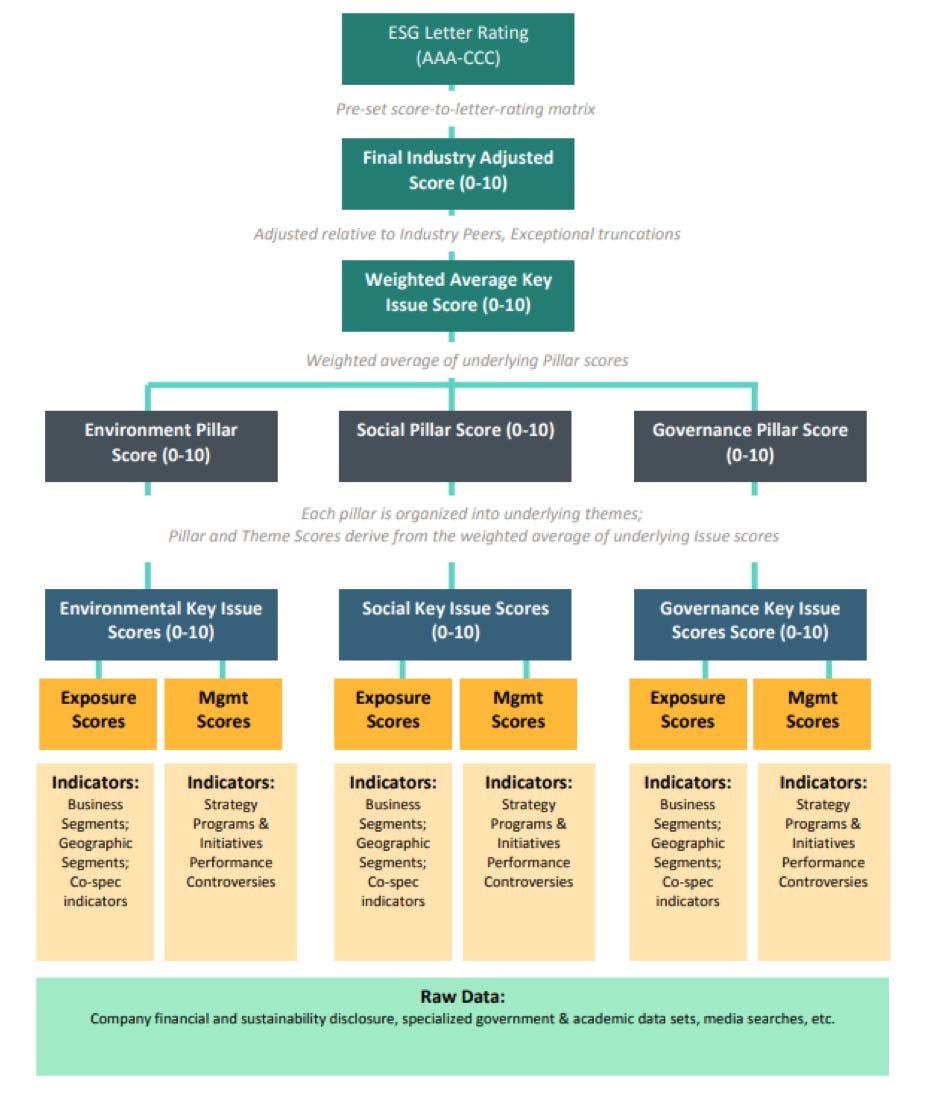

Once the exclusions noted above are completed, the remaining companies in the investable universe are assessed on a range of ESG factors. Information on these factors is collected by MSCI via original and third-party research with a focus on how a company manages the risks of its core business versus relevant industry peers. The final output after considering the ESG score of a company is a letter rating (AAA to CCC) that captures a range of normalized scores.

I. Key issues

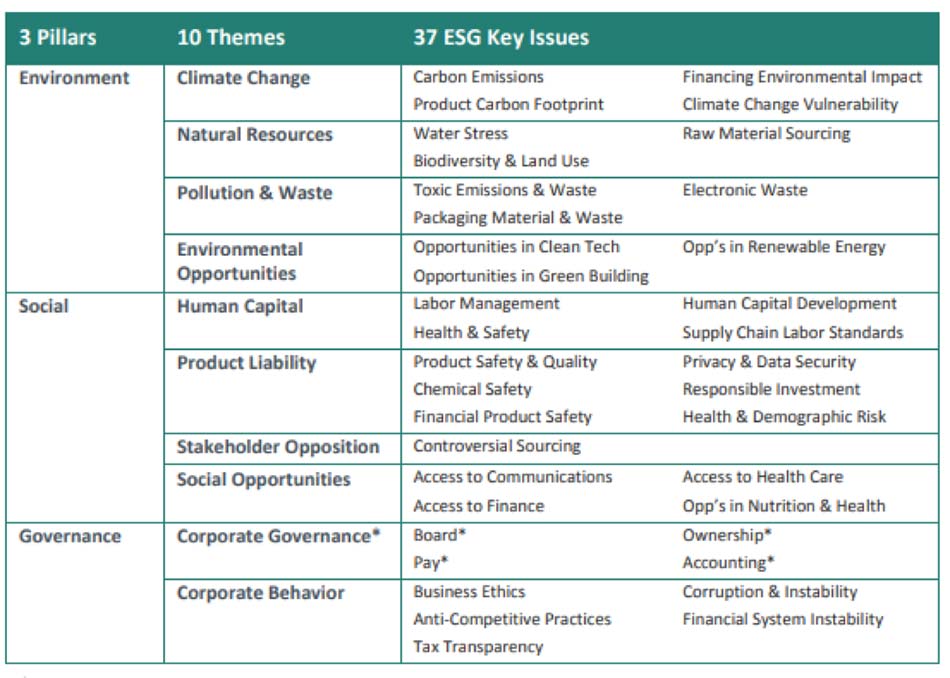

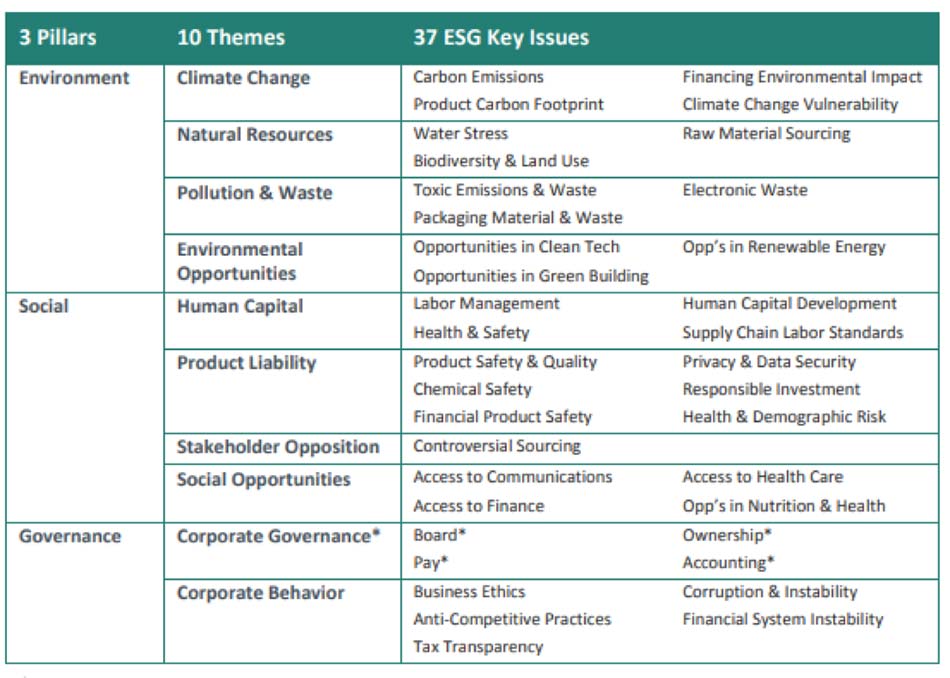

MSCI has identified 37 Key Issues, listed in Exhibit 3, drawn from 10 themes that align to an Environmental, Social or Governance risk.

Exhibit 3 ESG Factors and Issues

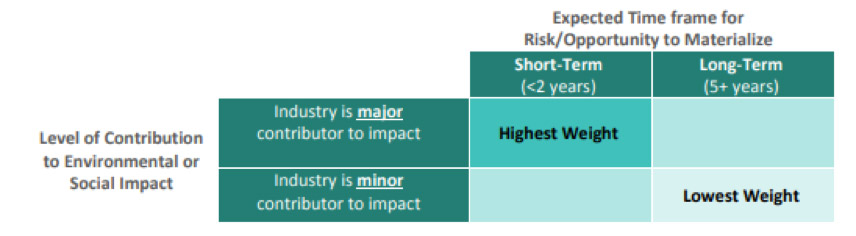

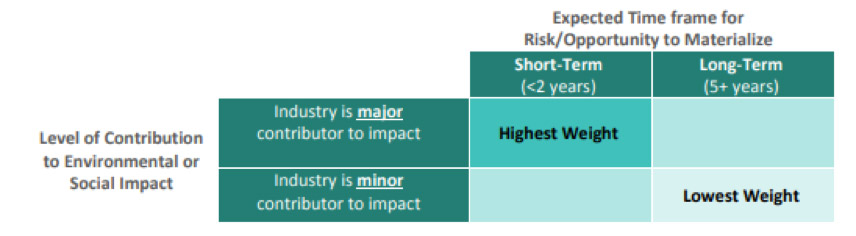

Key Issues are determined for particular sub-industries via a quantitative model and are then applied at the company level. The Key Issue risks are based on each industry’s overall external impact and the time horizon associated with each risk. All Key Issues and weights undergo a formal review at the end of each calendar year. The weighting of a specific Key Issue is generally 5%-30%. The weighting selection considers the contribution of the industry to the negative (or positive) impact on the environment or society as well as the timeline within which MSCI ESG Research expects it to materialize.

Exhibit 4 Weighting of Key Issues in an Industry Context

II. Key Issue Risk Assessment

MSCI calculates each Key Issue risk on a detailed examination of each stage of the company’s business activities, from its core products all the way down to the location of its factories. Exposure is then ranked from zero to 10, with zero representing no exposure and 10, very high exposure.

MSCI’s risk assessment takes into consideration 1) the exposure of a business to an identified risk and 2) the risk management strategies employed by a business.

MSCI assesses risk via a thorough analysis of each business. A qualitative assessment of a company’s core product and/or business segment, the locations of operations, and other risks related to production or distribution (i.e. use of outsourced production) and nature of revenue (i.e. high reliance on government contracts are captured as part of a risk exposure score. Risk exposure is scored on a zero to 10 scale, with zero representing no exposure and 10 representing very high exposure at the company level.

A subsequent risk management analysis how a company has developed strategies to manage the identified risks. Each business is scored on a zero to 10 scale, where zero represents no evidence of management efforts and 10 indicates very strong management efforts. Scores of risk exposure and risk management are combined such that a higher level of exposure requires a higher level of demonstrated management capability in order to achieve the same overall Key Issue score. Key Issue scores are also on a zero to 10 scale, where zero is very poor and 10 is very good. Exhibit 5 captures where the Key Issue score at the ESG level lies in the overall methodology.

Exhibit 5: Process for the Calculation of a Key issue Risk

III. Final index Construction

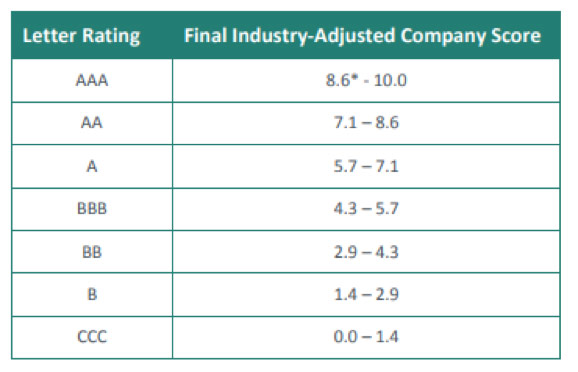

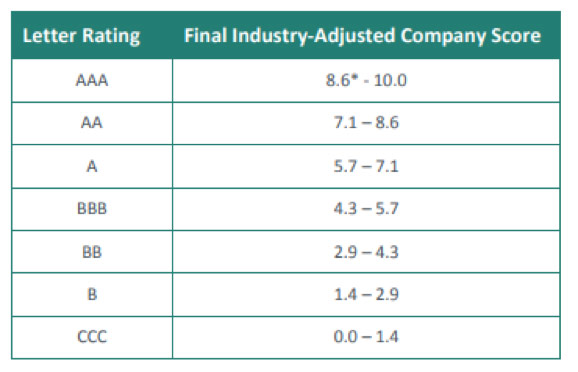

The constituents of each investable ESG indices are optimized through a normalization process that applies a letter rating commensurate with an industry-adjusted score at the company level, which is shown in Exhibit 6.

Exhibit 6: Letter Rating Legend for Industry Adjusted Company Scores

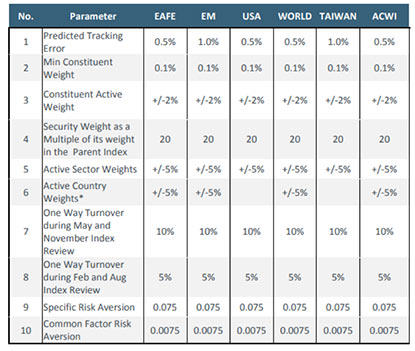

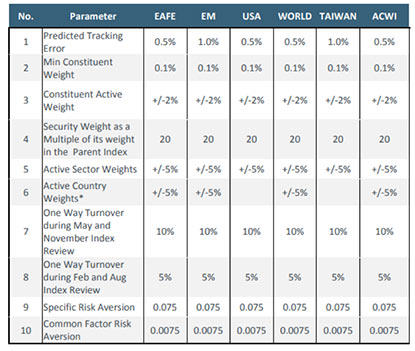

Index Optimization Constraints

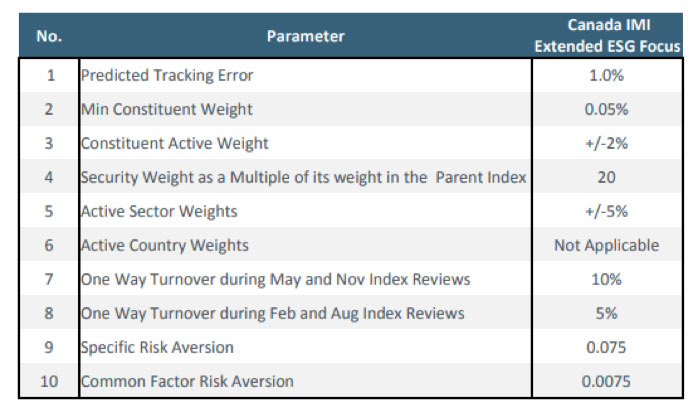

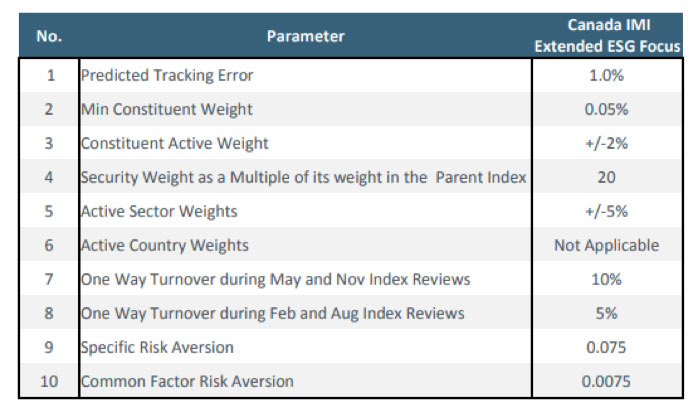

Following the identification of the parent index and the application of exclusions, constituents are selected for the ESG Index for the purpose of maximizing exposure to those companies that score highest on ESG scores subject to a risk budget. Specifically, the ESG Index aims to maximize exposure to companies with the highest normalized ESG scores at a specified tracking error, while maintaining similar risk and return characteristics to the Parent Index. MSCI completes this process with use of its Barra Open OptimizerLegal Disclaimer 2 in combination with a relevant Barra Equity ModelLegal Disclaimer 2. This process takes into consideration the weights from the Parent Index, the calculated ESG scores and the constraints in Exhibits 7 and 8 to determine how to effectively weight constituents in the ESG Index.

The optimization process undertaken by MSCI selects constituents for membership in the ESG Index based upon a number of factors. Those include ESG scores and additional constraints to normalize the ESG scores, constraints listed in Exhibit 7 and Exhibit 8, and the weight of the constituency in the Parent Index.

Exhibit 7: Optimization Constraints for Canadian Equity Market

Exhibit 8 Optimization Constraints for Markets ex Canada