When you deposit funds into your savings account, you earn some interest. While savings accounts may provide only a modest rate of return, they do offer the benefit of principal protectionlegal bug 1. As a result, savings accounts are certainly beneficial for building a rainy-day or emergency fund. Unsurprisingly, this is how many people leverage their Tax-Free Savings Account (TFSA)—it is called a "savings account" after all.

However, using your TFSA as a savings account could mean you may not be taking full advantage of a significant feature of this account. This would be the tax sheltering component or the "tax-free" in TFSA. As you likely know, any earnings within a TFSA are not taxedlegal bug 2. As a result, there could be potential to generate greater tax-free earnings if you use your TFSA as an investment account through which you could invest in stocks, bonds or ETFs.

Investing for the Long Term

When we invest in the stock or bond market, the investments are subject to market volatility. If we require funds on a short notice, perhaps for an upcoming family vacation, it might be unwise to have the funds invested in financial markets since we could experience losses if there is a market downturn.

Over the long term, however, investing in financial markets generally provides higher returns versus investing in a principal-protected investment, keeping in mind that there could be market volatility along the way. Therefore, it is advisable to invest funds in markets for longer term goals such as retirement, or funding your children’s education—assuming you are comfortable taking on some level of risk.

Since returns on savings accounts are relatively modest, the tax savings from sheltering those returns are also modest. By the same token, if we could earn higher returns by investing in financial markets within a tax-sheltered account, the tax savings would also be greater.

How much can I save by sheltering my investments?

Over the short term, the amount you save in taxes may seem small; however, over time, the impact that paying taxes on your investment income has on your investments can be significant.

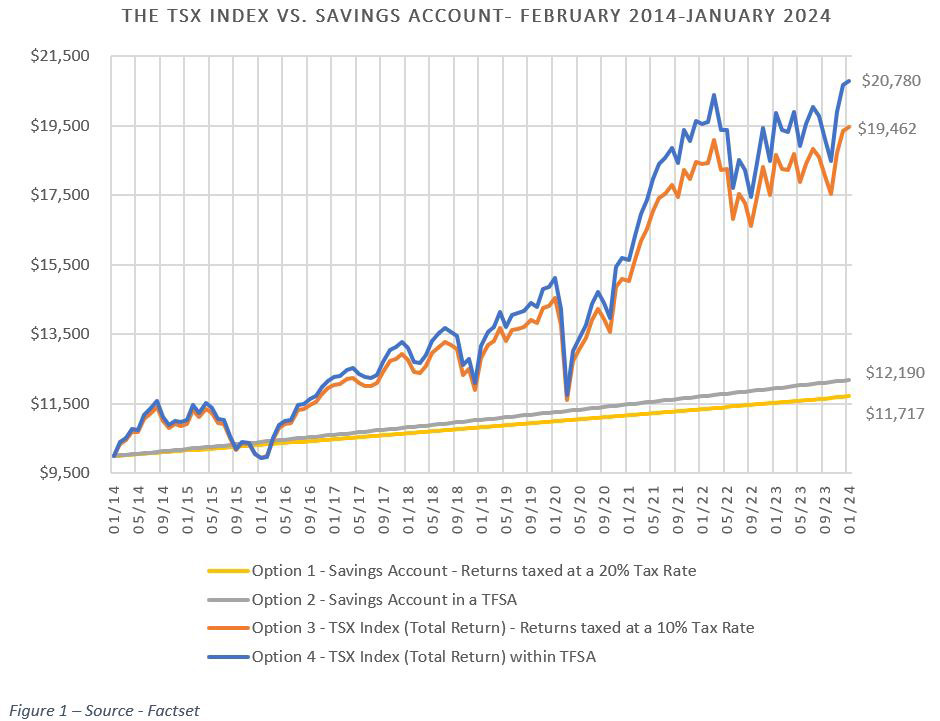

To illustrate this, let’s assume you had $10,000 to invest at the end of January 2014.

You have four options:

- Place the funds in a savings account that pays an annual interest rate of 2% with interest earned taxed at 20%.legal bug 3

- Place the funds in a savings account within a TFSA that pays an annual interest rate of 2%.

- Invest the funds in the S&P/TSX (Total Return) Index in a taxable account with returns taxed at 10%.legal bug 4

- Invest the funds in the S&P/TSX (Total Return) Index in your TFSA.

The chart below shows what your $10,000 would have been worth at the end of January 2024.

Investing your funds in the TSX Index would result in you earning significantly more than if you held the funds in your savings account. It is also worth noting that the value of your investment fluctuates considerably depending on if it was invested in the TSX Index versus the steady return you see in the savings account.

When looking at the tax savings over the 10 years, depositing the funds into the savings account would have saved $473 if the savings account was sheltered within the TFSA.

Conversely, if the funds were invested in the TSX Index within the TFSA, the tax savings would have equaled $1,318 over the same 10-year period. This is over two and a half times greater than what you would save if you sheltered your savings account within a TFSA (despite assuming a significantly lower tax rate to calculate taxes paid on the earnings from TSX Index (10%)legal bug 5 versus the taxes paid on the interest from the savings account (20%).).

Use your TFSA as an investment account and maximize the tax-sheltering benefits of the account

Once you have your short-term liquidity needs set aside in a regular savings account, by thinking of your TFSA as a Tax Free “Investment” Account and using it to invest in financial markets for your medium-to longer-term goals, you can maximize the tax-sheltering benefits of the account.

At RBC InvestEase, we provide an investment portfolio aligned to your objectives and help you take advantage of TFSAs and other tax-sheltered accounts to ensure that you are best positioned to achieve your financial goals.