Let Our Pros Pick, Buy and Manage Your Investments for You

Put your money to work without doing the heavy lifting. RBC InvestEase is a low-cost, low-effort online investment service that combines smart technology and personalized advice to make investing simple and stress-free.

Get a Professionally-Managed Investment PortfolioLegal Disclaimer 1 without the Work

Save for your first home, that emergency fund you’ve been meaning to start or even retirement.

- Get matched to a low-cost portfolio of exchange-traded funds (ETFs) based on your answers to some simple questions

- Choose a or invest in a

- Save for a wide range of goals in a TFSA, FHSA, RRSP or non-registered account

- Get back to your life while we manage your investments for you

An investment portfolio is a container that holds all your investments...like stocks, ETFs, mutual funds and cash.

At RBC InvestEase, our portfolios are made up of ETFs and cash.

Explore our ETF Portfolios.ETFs are designed to hold stocks and bonds in a single container. That container is a fund you can buy.

While they're similar to mutual funds, ETFs don't have investment minimums. Also, an ETF can offer more trading flexibility since it trades on an exchange (like a stock) throughout the day, with prices fluctuating continuously.

A Standard Portfolio may be ideal for anyone who wants to save for the future while minimizing investment fees.

Explore our ETF Portfolios.A Responsible Investing Portfolio may be ideal for anyone who wants to invest with purpose while saving for the future.

Learn more about Responsible Investing or explore our ETF Portfolios.

Know That an Expert Team Has Your Back

Behind the scenes, there’s a talented team of Portfolio Advisors taking care of the important stuff, like:

- Keeping an eye on your investments

- to help you reach your goals

- Providing advice if you need it

In the world of investing, balance is having the right mix of investments (or assets) in your portfolio to help reach your goals.

Over time, deposits, withdrawals and performance can cause your portfolio to drift from its original mix. To help keep your portfolio on track, we will buy or sell the appropriate exchange-traded funds (ETFs) to rebalance your portfolio.

Start Small or Go Big—It's Up to You

Get started with any you’re comfortable with. We’ll automatically invest it for you once your balance reaches $100 or moreLegal Disclaimer 2 so that you can benefit from and start growing your money.

RBC InvestEase and NOMI Insights are making investing even easier

NOMI Insights for RBC InvestEase helps you make progress towards your financial goals by letting you know when you may have spare cash available to invest.

For balances of $100 to $1,499, we invest in a “Small Balance portfolio,” which is similar to a full portfolio, but with fewer exchange-traded funds (ETFs).

When your balance rises above $1,500, we transition you to a full portfolio. The best part? There's no additional cost or action you need to take.

Unlike simple interest, where you earn interest on your initial deposits only, compounding returns means "interest on interest". The interest earned on your contribution amounts is reinvested, so you earn interest on the new total—the original amount plus the interest.

The longer you stay invested, the bigger the impact of compounding. That's why it's so smart to start investing early.

Getting Started is Quick and Easy

- 1. Tell Us About You

- 2. Confirm Your Portfolio and Open an Account

- 3. We Keep Your Portfolio on Track

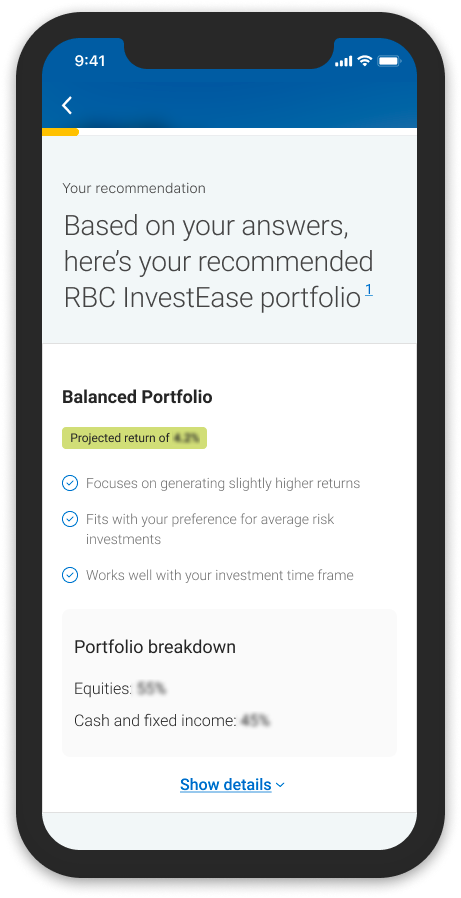

To get the ball rolling, we’ll ask you some simple questions so we can recommend a portfolio that aligns with your investing goals, timeframe and feelings about risk.

We offer five types of ETF portfolios, ranging from very conservative to aggressive growth. Each portfolio is available in two versions—Standard and Responsible Investing.

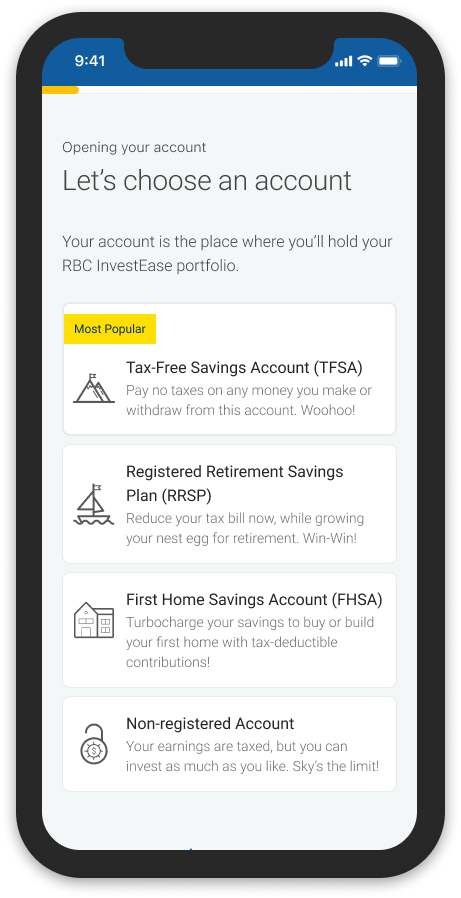

You can choose either the Standard or Responsible Investing version of the portfolio we recommend for you, as well as the account you want to hold it in. Choose from a Tax-Free Savings Account (TFSA), First Home Savings Account (FHSA), Registered Retirement Savings Plan (RRSP) and non-registered account.

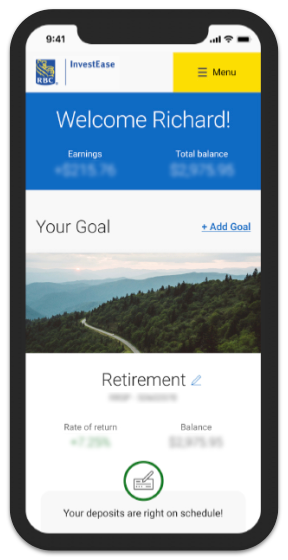

After you have opened your account and made your first depositLegal Disclaimer 2, our Portfolio Advisors take care of buying and managing your investments for you. You can log in anytime to check your progress, create new goals and transfer more money into your account.

Tip: Consider setting up ongoing deposits to put your savings on autopilot. Once the money is in your account, we’ll invest it for you.

More Reasons to Invest With Us

More Money in Your Pocket

Pay a low management fee of just 0.5% per year on your balanceLegal Disclaimer 3, plus standard fund manager fees.

Answers from Real People

Reach our Portfolio Advisors by phone or email if you have questions or want advice.

Reliability and Security

RBC InvestEase is backed by RBC—an organization that Canadians have trusted for over 150 years.

Ready to Start Investing?

Get a professionally-built and managed investment portfolio without the work.

Explore Topics & Trends

Saving for your First Home? Understanding how the First Home Savings Account (FHSA) Works

This month, we are exploring the new First Home Savings Account (FHSA) which is designed to help Canadians save for their first home in a tax-efficient way. At RBC InvestEase, we are eager to help our clients achieve the “first home milestone” and are excited to offer the FHSA beginning of spring of 2023.

The Tax Free "Investment" Account

When you deposit funds into your savings account, you earn some interest. While savings accounts may provide only a modest rate of return, they do offer the benefit of principal protectionlegal bug1. As a result, savings accounts are certainly beneficial for building a rainy-day or emergency fund. Unsurprisingly, this is how many people leverage their TFSA - it is called a "Savings Account" after all.

How to Be Healthy, Wealthy and Wise

Becoming healthy, wealthy and wise may be the ultimate trifecta — but it doesn't happen overnight. It will take a little work to get there.

The first step is to consider what your goals are for your money, your career and the kind of lifestyle you want. From there, investing in you and being both healthy and educated can help you reach your financial goals.

The services provided by RBC InvestEase are only available in Canada.